Grindlays Bank (GB) - 1883 to London; 1943 to Bombay

Grindlays Bank

The Story

The origins of Grindlays Bank trace back to 1828 when Captain Robert Grindlay founded Leslie & Grindlay in London. Initially headquartered in Birchin Lane before moving to Parliament Street, the firm established itself as a prominent financial institution primarily serving the British Army and business interests in India.

The bank underwent several significant transformations in its early years. In 1839, a change in partnership led to its first renaming as Grindlay, Christian & Matthews. By the time of Captain Grindlay's retirement in 1842, the institution had earned a prestigious reputation as "the most distinguished bankers and agents to the civil and military officials of the business community and the British Army in India." Following this, in 1843, the firm was renamed Grindlay & Co.

The mid-19th century marked the beginning of the bank's expansionary phase. Starting in 1854, the firm extended its operations beyond its original markets, establishing presence across India, Europe, the Middle East, South-East Asia, and Africa. This expansion significantly enhanced its international footprint and capabilities.

The twentieth century brought major corporate restructuring to the institution. In 1924, the National Provincial Bank acquired the firm, converting it into a company while allowing it to maintain operational independence as Grindlay & Co Ltd. In 1947, the institution was renamed Grindlays Bank Limited. The following year marked another significant change when the National Provincial Bank sold Grindlays to the National Bank of India, though retaining a minor shareholding in the institution.

Philatelic Interest: The 1883 cancellation is Jal Cooper Type 34/35 type with letter L.

Allahabad Bank - 1891 Dalhousie To Allahabad

Allahabad Bank

The Story

Allahabad Bank, established in 1865 in Allahabad, stood as one of India's oldest joint stock banks and was among the first financial institutions founded on Indian capital. The bank demonstrated remarkable growth in its early years, expanding its presence across northern India. By the end of the 19th century, it had established branches in major cities including Calcutta, Delhi, Jhansi, Kanpur, Lucknow, Bareilly, Nainital, and Mussoorie.

The early 20th century brought significant changes in ownership. In 1920, P&O Banking Corporation acquired Allahabad Bank at ₹436 per share. This was followed by another change in 1927 when the Chartered Bank of India, Australia and China acquired P&O Bank, though they maintained Allahabad Bank as a separate operational entity.

A pivotal moment in the bank's history came in July 1969 when it was nationalized by the Indian government. The bank achieved a notable milestone when its Moradabad branch became the first nationalized bank outside a metropolitan city to handle foreign exchange business. The following decades saw further expansion, including the acquisition of United Industrial Bank in 1989. In 2002, the bank marked another significant development by issuing equity to the public. However, the bank's independent journey came to an end in 2019 when it merged with Indian Bank and ceased to exist as a separate entity.

National Bank of India (NBI) - 1904 to Antwerp -Anvers(Fr); 1933 to Ajmer

The National Bank of India

The Story

The Calcutta City Banking Corporation was formed in 1863 as an Indian registered bank. The bank changed its name to the National Bank of India (NBI) and moved its registered office to London. Other than London and Calcutta it had a branch in Bombay.

The bank had a unsuccessful stint in China but prospered in East Africa. It benefited from Zanzibar’s free port status and was a key player in construction of railway line from Mombasa to Lake Victoria.

In the early decades of 1900s, it was the seventh largest of the London-registered overseas banks. In 1948 NBI purchased Grindlays Bank a much smaller rival and operated under the name National Overseas and Grindlays Bank. In 1961, Lloyds Bank took a 25 per cent share in the bank and in 1969 Citibank took a 40 per cent stake. In 1975 the suffix National was dropped and the bank started to operate as Grindlays Bank.

In 1984 Citibank and Lloyds sold Grindlays to the Australia and New Zealand Banking Group and was rechristened ANZ Grindlays in 1989. In 2000, ANZ sold ANZ Grindlays subsidiary to Standard Chartered, which in-turn merged it with its existing banking operations.

Note: Also, see mail from National Bank of India to Lloyd Triestino, a shipping company - correspondence in reference to shipping documents.

A 1942 Envelope to The Ottoman Bank, Baghdad

The Ottoman Bank

The Story

The Ottoman Bank was founded in 1856 and headquartered in Constantinople. It was called the Imperial Ottoman bank from 1863 to 1925. It was the “state bank” of the Ottoman Empire and one of the largest in the world.

In its heydays, it was the lender to the Ottoman government and had monopoly on issuance of banknotes. The bank at one point had 83 branches including three head offices. In consortium with different banks, it was involved in financing of railways, ports, tobacco company and had investments in South African gold mines.

Post World War I, in 1920 Banque Paribas took control of the bank and renamed it Ottoman Bank. Subsequently, in 1996,on purchase by Garanti Bank it passed into Turkish hands and was renamed Garanti BBVA in 2019.

The envelope above addressed to Ottoman Bank is from National Bank of India. Read here to know more about National Bank of India.

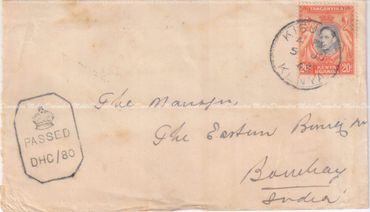

A 1943 Envelope to The Eastern Bank, Bombay, India, from the Barclays Bank Kenya

The Eastern Bank Limited

The Story

Eastern Bank Limited was founded in 1909 in London to help finance trade with the far-east. Soon it had branches in Bombay and Calcutta.

It expanded fast and established branches in Iraq (Baghdad, Basra, Mosul, Kirkuk etc.), Ceylon, Singapore, Bahrain, India (Karachi, Madras etc.), Malaysia, Qatar, Syria etc.

The 1957 Mundhra scandal in India resulted in huge losses. Over the years Barclays Bank and the Sassoon family had cornered controlling stake (65%) in the Bank. The two sold it to Chartered Bank which in turn merged into Standard Bank of South Africa to form Standard Chartered Bank in 1969.